By Alicia Arjunan, Underwriter, PARTNER RISK

Cyclical Shifts in the Insurance Market

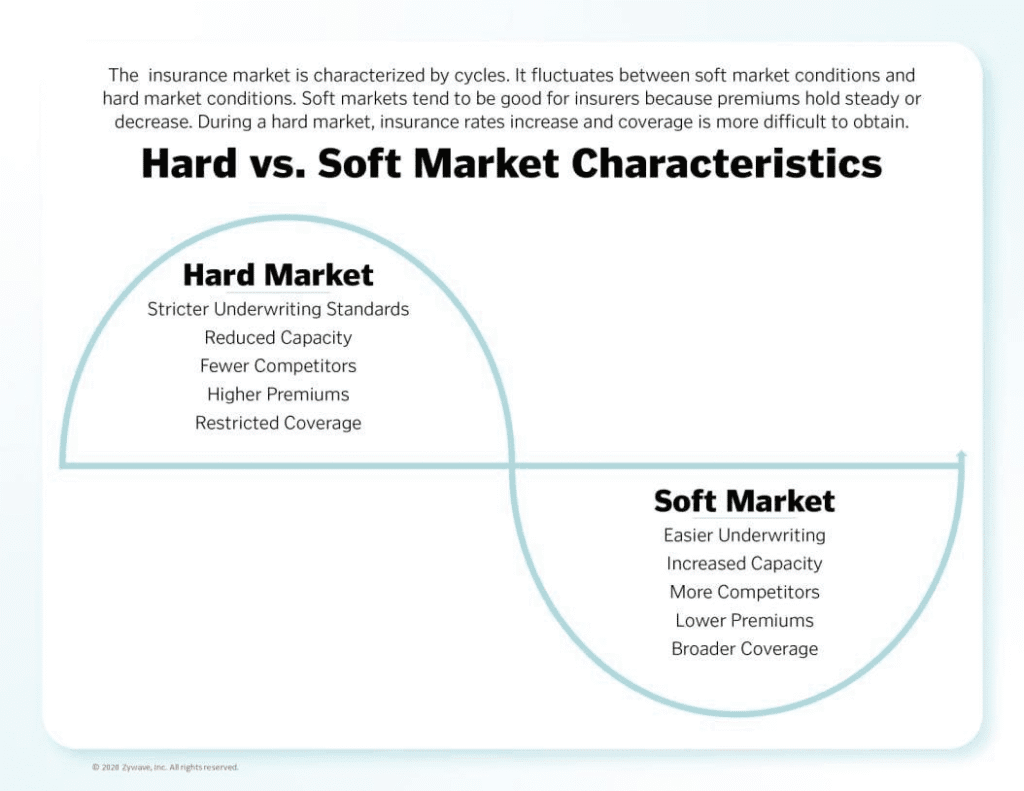

An ongoing topic of discussion among key players in the South African insurance sector is the current soft market cycle. The insurance industry moves between hard and soft market conditions, shaped by socio-economic factors, catastrophe loss events, and broader market dynamics.

Recent years have reflected this cycle clearly: the KwaZulu-Natal floods, prolonged load-shedding, and the COVID-19 pandemic were followed by a period of hardening, with more stringent underwriting standards. Today, however, the market has shifted back into softer territory, characterised by more relaxed terms, increased insurance capacity and competition in the Property class of insurance business.

Market Dynamics: What Defines a Soft Market?

A soft market typically arises when global insurers and reinsurers ‘inject’ surplus capital into the system. Under these conditions, brokers on behalf of their clients have more room to negotiate better terms and conditions.

According to Aon South Africa’s 2025 market analysis, overall pricing has remained broadly flat, with downward pressure in certain classes such as commercial property. Indicators of the softening cycle include:

- Stable or lower premiums

- Broader coverage terms and fewer exclusions

- Increased reinsurance capacity

- Strong competition for market share

- Aggressive broker-driven negotiations

While this creates opportunities to place risks that were previously considered difficult, it also brings challenges. Insurers and Underwriting managers (called Underwriting Management Agencies (UMAs) in South Africa) face:

- Margin pressures as renewing existing and binding new business become more competitive.

- Relationship strain as capacity providers defend their underwriting disciplines and insurance buyers push hard to get better insurance terms.

- Sustainability challenges when pricing becomes too thin.

The real test comes when a major loss event occurs. If pricing has dropped below economic levels, then UMAs, their insurers and reinsurers can be left with significant losses. This can lead to reduction or withdrawal of insurance capacity and/or sharp increases in reinsurance costs which put pressure on insurance costs to the insured client. Since South African insurers rely heavily on global reinsurance support, excessively low pricing is not sustainable in the long term, a view supported by McKinsey’s global insurance research.

Figure 1: Hard vs soft insurance market cycle (Bitner Henry Insurance Group, 2024)

Earnings Stability: Why Sustainable Insurance Pricing and Underwriting Matters

The concept of “earnings smoothing” is often misunderstood. Some critics equate it with financial manipulation, but in reality insurance provides a legitimate mechanism for companies to manage earnings volatility.

For businesses under pressure to meet quarterly targets, a single uninsured loss can disrupt an entire financial year. Appropriately structured insurance allows companies to absorb the losses from unexpected events and maintain financial consistency.

In discussion with PARTNER RISK Managing Director Gareth Baines, the idea of smoothing can also be viewed at a policy and portfolio level.

If tempered price reductions are applied in soft markets and tempered increases are applied in hard markets, the outcome could be a more balanced and sustainable experience for all parties. This approach requires a deep understanding of a client’s risk profile, coupled with a trusted relationship built over years of sound advice and respect. As Baines notes, “Competition will always drive brokers to seek the lowest price, but long-term trust and measured adjustments can create benefits for the underwriter, the broker and the insured client.”

Sustainable underwriting is therefore not about short-term pricing gains. It is about enabling every-day certainty for businesses and protecting shareholder confidence, client stability, and long-term industry credibility.

Who Benefits, and How Do Insurers and UMAs Stay Relevant?

Today’s soft market primarily benefits insureds, brokers, and capacity providers re-entering or increasing their presence in South Africa at more competitive terms. Placements are increasingly moving into global programmes when local insurers or UMAs cannot match price or product innovation.

This raises important questions for brokers and insureds:

- Can the pricing from new capacity providers in South Africa withstand significant insured losses in South Africa?

- What is their claims-paying track record?

- In the event of a large insured loss, will their capacity remain in South Africa, or will it dry up?

Brokers who address these questions and remain mindful of the longer term benefits of finding local solutions and maintaining local relationships could well position themselves as trusted advisers rather than transactional intermediaries. However, the reality of competition can result in unexpected outcomes and lessons for brokers and insurers/UMAs alike.

PARTNER RISK Solutions: Our Approach to Sustainability in Underwriting

At PARTNER RISK Solutions, we recognise the cyclical nature of the market and continue to position ourselves for sustainable growth by:

- Living our Responsible, Reliable, Relevant (RRR) value system through shared underwriting and risk management practices in collaboration with our partners.

- Maintaining underwriting discipline in consistent risk selection in line with our risk appetite.

- Investing in people, ensuring that empathy, talent, and skills development remain at the centre of our business that ultimately lead to overall excellence.

- Leveraging technology and AI to improve efficiency, reduce turnaround times, and enhance engagement with all stakeholders.

Additionally, PARTNER RISK Solutions is the only insurer that offers a low-claims bonus called PayBack which contributes toward risk management expenditures made by our insured clients. Through this initiative, clients demonstrating effective risk management benefit from premium returns in the form of the PayBack undertaking.

By rewarding proactive risk management and good claims experience, we ensure our clients achieve maximum value for their premium spend while we continue to compete on expertise, service, and innovation regardless of where the market sits in the cycle.